Mortgage Calculator helps estimate the monthly Mortgage Payment due along with other financial costs associated with the Mortgage Loan. When you are calculating your Mortgage loan, you must set a budget and search for a mortgage loan that fits within your financial guidelines.

Our Free Mortgage Calculator is here to help simplify the process of choosing the best Mortgage Loan for you. It helps you understand what factors affect your monthly Mortgage Payment so that you can be confident in your choice of mortgage. It will also help you understand how large of a home you can afford or how a Mortgage Refinance will affect your budget.

Using our Mortgage Calculator could not be easier and you simply need to input your information into each selection of the Mortgage Calculator and Press the Calculate Now Button. You simply need to input the following information when using the Mortgage Calculator:

- Interest Type

- Interest Term

- Interest Rate

- Loan Term

- Amortization Period

- Amount of the mortgage in the proper denomination

- Starting Date of Loan

Mortgage Calculator Components

- Loan Amount: It is the amount borrowed from a Bank or Mortgage Lender. In a Mortgage Loan, this amounts to the purchase price minus any down payment. The maximum loan amount one can borrow normally correlates with household income or affordability.

- Down Payment: It is the upfront payment of the purchase, usually a percentage of the total price. It is the portion of the purchase price covered by the borrower. Typically, Mortgage Lenders want the borrowers to put in 20% or more as a Down Payment. In some cases, borrowers may put down as low as 3%. If the borrowers make a down payment of less than 20%, they will required to pay private mortgage insurance (PMI).

- Loan Term: The Loan term is the amount of time over which the loan must be repaid in full. Most fixed-rate mortgages are for 15, 20, or 30-year Loan Term. A shorter period such as 15 or 20 years, typically includes lower interest rates.

- Interest Rates: The Mortgage Rate is the percentage of the loan that is charged as a cost of borrowing. Mortgages can be charged either fixed-rate mortgages (FRM) or adjustable-rate mortgages (ARM)

How To Calculate Your Mortgage Payment?

Here is How To Use a Mortgage Calculator to Calculate Your Mortgage Payment:

- STEP I: Input the Price of the home you are purchasing or the Current value of your Home if you are refinancing.

- STEP II: In the Down Payment field, Input the amount of your Down Payment in case you are buying or the amount of equity you have in case you are refinancing.

- STEP III: In the Loan term field Input the length of your loan, it can be usually 30 years, but could be 20, 15, or 10.

- STEP IV: In the Interest Rate field, Input the rate you expect to pay or are currently paying.

- STEP V: Input the Property Tax, Property Insurance, and First Payment Date in the desired field and Click the “Calculate” Button

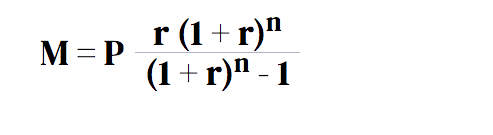

Mortgage Payment Formula

For the mathematically inclined, here is the complete formula to help you calculate your mortgage payments manually:

| Symbol | |

|---|---|

| M | Total monthly mortgage payment |

| P | Principal loan amount |

| r | Monthly interest rate: Lenders provide you an annual rate so you’ll need to divide that figure by 12 (the number of months in a year) to get the monthly rate. If your interest rate is 5 percent, your monthly rate would be 0.004167 (0.05/12=0.004167). |

| n | Number of payments over the loan’s lifetime: Multiply the number of years in your loan term by 12 (the number of months in a year) to get the number of payments for your loan. For example, a 30-year fixed mortgage would have 360 payments (30×12=360). |

Frequently Asked Questions (FAQs)

Question 1: How Should I Use This Mortgage Calculator?

Answer: This Mortgage Calculator should be used to get an estimate of how much your Mortgage will cost over the life of the Loan. You can also change your figures to see how much you will pay if you add additional payments outside of the regular payment.

Question 2: How Do I Calculate Mortgage Amount?

Answer: There are various ways to Calculate Mortgage Amounts. If you have a specific home in mind, then you can use the selling price as a starting point. You may end up with an amount that is less if you negotiate a lower price with the seller. You can also seek pre-approval from your Mortgage Lenders. The financial institution will let you know exactly how much they are willing to lend you for a home based on your income, credit score, and other factors. You can also enter this amount into the Mortgage Calculator to know how much your payments will be.

Question 3: What determines the Loan Term?

Answer: A Mortgage Loan term refers to the frequency of the Mortgage Payments on the Loan. Most Mortgages have a Loan term of 30 days or one month. Your Mortgage Lender will determine your Loan Term. However, you have the option to make additional payments every month above your regular scheduled payment.

Question 4: How much Do Interest rates vary?

Answer: Mortgage interest rates can vary rapidly. The Rate of Interest will depend on your credit history, your income, and your debt-to-income ratio. The Interest rates will vary among different lenders in different regions. Your Down Payment will also have an impact on your interest rate.

The Final Verdict

If you are considering homeownership for the first time, but are not sure what kind of house you can afford Then Mortgage Calculator is the best tool that you can use to determine your monthly mortgage payments. A Mortgage Calculator helps borrowers to estimate their Monthly Mortgage Payments. When You use our Mortgage Calculator, It will Factor in frequently overlooked costs like property taxes and homeowners insurance. Our Mortgage Calculator can help you determine the type of home you can afford. And you can tweak things like the home price or loan terms to find the best mortgage options for your budget.